Revolutionizing Healthcare The Blockchain Advantage

Revolutionizing Healthcare: The Blockchain Advantage

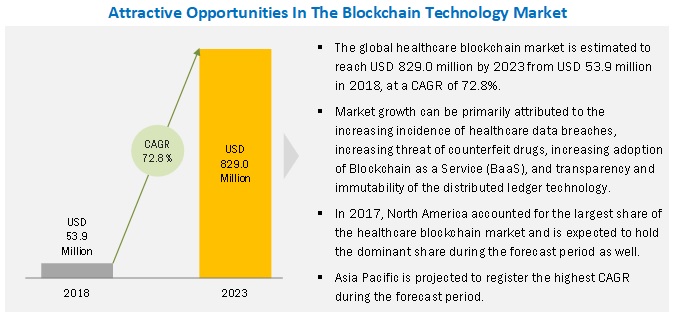

In the ever-evolving landscape of healthcare, a revolutionary force is making waves – blockchain technology. Beyond its association with cryptocurrencies, blockchain is reshaping the way we manage health data, provide patient care, and ensure the security of sensitive medical information.

Secure Solutions: Blockchain’s Role in