Bigg Digital Unleashed Navigating the Digital Frontier

Embarking on the Bigg Digital Journey: Redefining the Tech Landscape

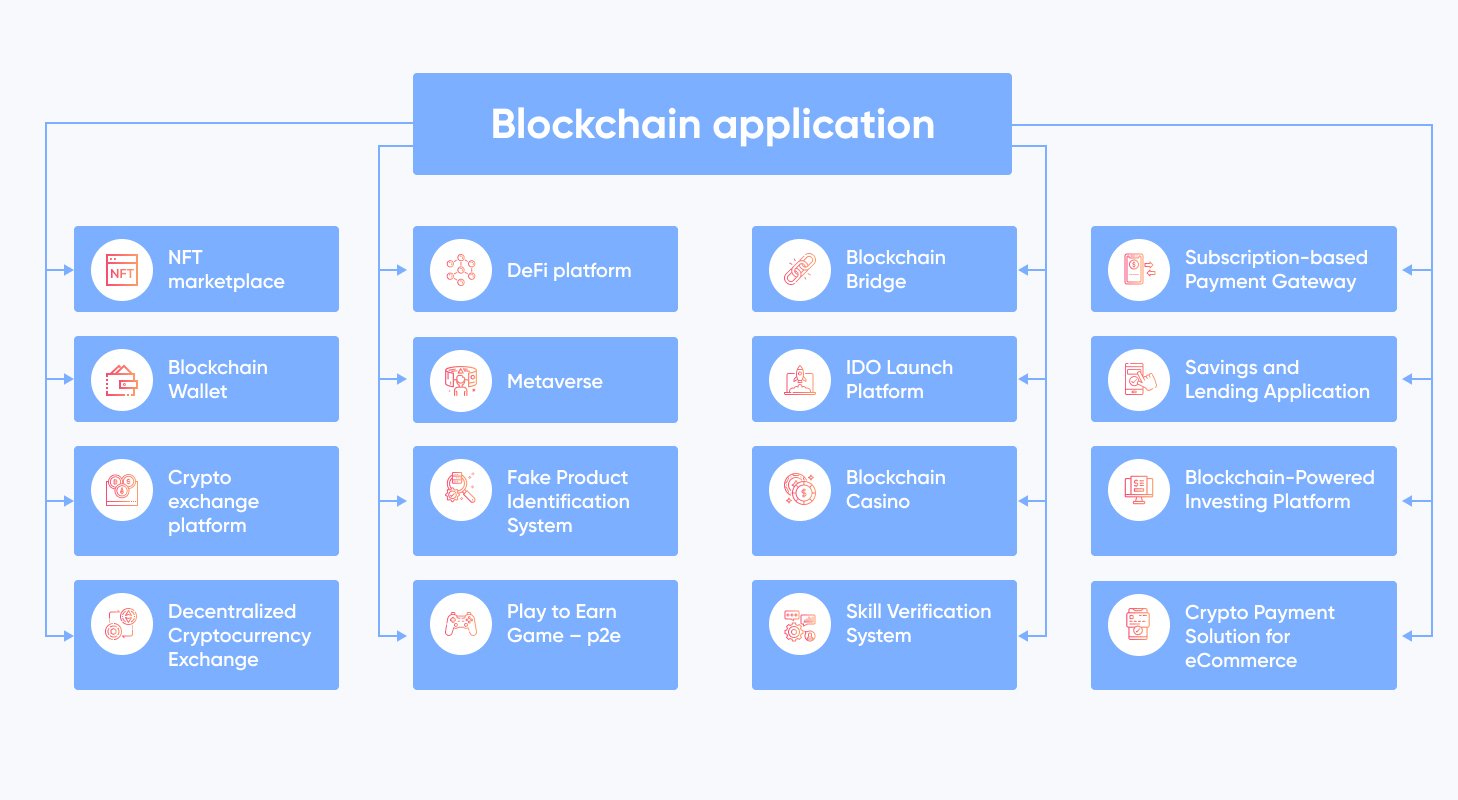

Innovative Tech Marvels Unveiled

Bigg Digital has stepped onto the scene, bringing a wave of innovative tech marvels that promise to reshape the digital landscape. From cutting-edge solutions to groundbreaking advancements, this digital powerhouse is making waves, offering a glimpse